0

SMATER DIVERSIFICATION

Now you can diversify outside of the public markets with private real estate, allowing you to reduce risk and improve stability with an option of over 150k+ properties to choose from based on you portfolio .

0

INSTITUTIONAL QUALITY WITHOUT THE HIGH FEE

The fees you pay affect your bottom line. Our proprietary software helps us reduce costs, which means we can charge lower fees, so you can maximize your returns.

0

FLEXIBLE INVESTMENT MINIMUM

Unlike most private real estate investments, our low minimums give you the flexibility to invest the right amount, at the right time, to meet your goals. Properties across the country are improved and operated via dynamic asset updates

Browse

Marketplace

Interested in investing in Single-family, Multi-family Residential, or Commercial properties?.

Discover More

Create a free account to get a tailored list of investment opportunities that will help you meet your financial goals.

GET STARTEDHow do returns work at Osaic REITs?

Osaic REITs investor portfolios have the potential to generate dividends on a quarterly basis while their shares also grow in value over time. These returns ultimately come from the individual real estate assets in your portfolio – interest or rental income collected, as well as potential appreciation in the property's value.

How does liquidity work at Osaic REITs?

we understand that investors may want or need to prematurely liquidate (or "redeem") their shares. Accordingly, our investors may request to redeem shares at any time, although such redemption cannot be guaranteed — especially in times of economic uncertainty — and there may be costs associated with premature redemption.

Is Osaic REITs a long-term investment?

Like all private real estate investments, investments in Osaic REITs should be viewed as long-term (4+ years). This is because nearly all of the most effective real estate investing strategies require a combination of both expertise and time to pay off. We select strategies based on their long-term return potential for our investors, not short-term optics. If you anticipate needing your investment back in the near-term, we don't recommend investing with us.

Why crypto payment method?

Cryptocurrency as a means of payment enables investors make transactions at lesser costs, less charges , faster and much easier. With Cryptocurrency being accepted widely around the world, Osaic REITs uses a cryptocurrency method of payment to enable its large international transactions be done speedily to serve our investors better. Cryptocurrency transactions do not incur extra banking fees which enables investors make smooth and accurate transactions.

Your portfolio is powered by high-quality, resilient assets.

Our assets drive your returns. We pair our extensive network and expertise with the

collective buying power of our investor community

to acquire high-quality assets ranging from

debt to equity, commercial to residential, and more.

Who can invest with Osaic REITs?

Anyone who is a citizen (or permanent resident) residing in any cuntry who is over the age of 18. No accreditation required.

The future of real estate investing.

Within minutes, you can create an account, choose your portfolio strategy, and watch as your dollars are diversified across a series of investment funds.

HOW IT WORKS ?

How does pricing work?

Investors pay a 0.15% annual investment advisory fee, which may be waived under certain circumstances. This means that over a 12-month period, you will pay a $1.50 advisory fee for every $1,000 you've invested with us.

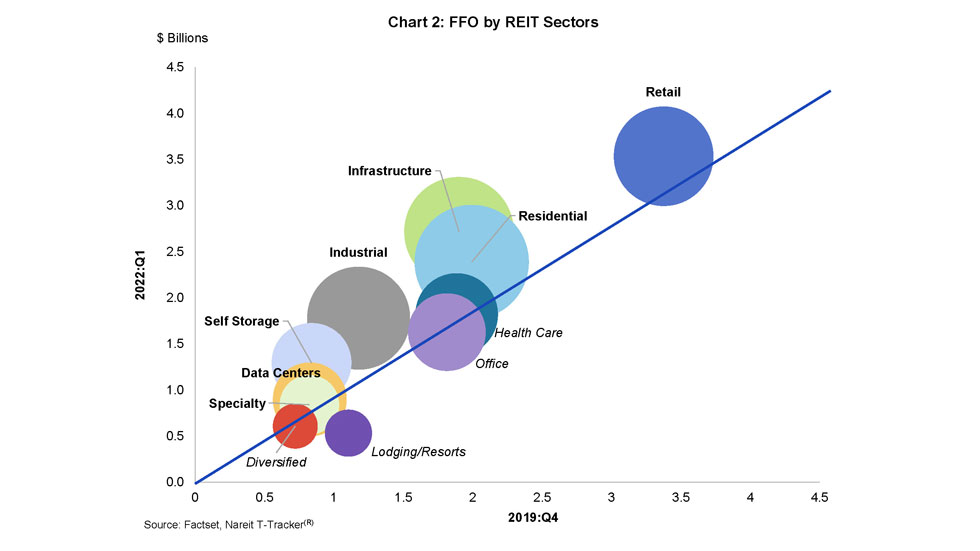

Income through dividends

Real estate allows investors to accrue a unique mix of both long-term appreciation and income potential. The figures here represent the income portion of client returns through Osaic REITs and do not include appreciation over time.

Potential new acquisitions under contract

We’re continuing to look ahead to another two potential acquisitions of apartment communities in the upcoming months — as always, investors can expect to receive timely updates about any future acquisitions.

Portfolio financing obtained for rental assets

Our goal with our single-family rental home assets is to build out a portfolio that can achieve operating economies of scale. While we initially acquired the homes via all-cash purchases, our intent from the beginning has been to obtain portfolio-level financing.

Begin your Real Estate Investment Trust (REIT) Journey

Everything You Need To Manage Private Placements

Forget about the hassles of compliance burdens, tech stacks, and paperwork.

It’s

time to leave your legacy system behind.

Grow Your Investor Deal Flow. Not Your Workload.

Everything You Need To Manage Private Placements Managing private placements has never been easier, faster, or more scalable.

About Us

Real estate strategies

By employing a combination of strategies, we aim to build well-rounded, resilient portfolios targeted to deliver consistently strong results based on our clients’ goals and appetite for risk.

Read docsFixed Income

Our Fixed Income strategy seeks to generate above-market yields by providing creative and comprehensive financing solutions underpinned by high-quality real estate.We seek to lend with a margin of safety to product types with high durability of demand (e.g., housing) and real constraints on new supply, thereby supporting property values.

Let's startCore Plus

Our Core Plus strategy features stabilized real estate with a long investment horizon and moderate leverage, where we can unlock additional value through focused asset management. We aim to buy quality assets at an attractive basis in growing markets across residential and industrial asset classes.

Value Add

Our Value-Add strategy focuses primarily on acquiring existing properties below replacement cost and investing capital to increase their competitiveness. We focus primarily on acquiring reasonably-priced residential communities in growing markets where affordable rental housing is scarce.

Affiliated With Over

153k+ properties across 7 coutries

Our opportunistic strategy seeks affiliation with property owers and also acquire underutilized, well-located properties in the most dynamic markets. With the combined expertise of our in-house development team and best-in-class partners, we reimagine these properties, often from the ground up. These business plans are the most complex and longest-dated that we execute, but carry the potential for the greatest reward.

Get started today.

Signing up for Osaic REITs takes only minutes.

Having investment properties in your portfolio shouldn’t be exclusive to the ultra wealthy. Start reviewing a list of pre-vetted investments the moment you sign up, and work with a dedicated licensed Dealing Representative to get you started on your first investment.

GET STARTEDIndustrial properties

Want more?

While we have continued to make progress scaling up our affordable rental housing portfolios, we’re also targeting new acquisitions across different asset types with the goal of creating a diversified portfolio. We believe that the long term trend of more shopping moving online, which has been accelerated by COVID-19, and customer demand for faster delivery times will continue to support a growing demand for distribution centers near major metropolitan areas.

Thank you for your support!

We offer the best real estate investment opportunity.